Be Smart About Financial Performance

Spray Foam Magazine – Fall 2020 – Does a contractor want to be known as the most price-competitive insulation contractor in the market working for minimum margins, or do they want to be recognized as the best in the market with higher margins?

Spray foam insulation is a performance driven industry and it is up to each contractor to differentiate from the competition. It starts with accurate estimating, the right labor skill set, right products, and a consistent high level of execution. It is these four variables that will determine how a company is perceived in the marketplace and it is critical that a consistent diagnosis and measurement of a company’s performance is completed to ensure the performance is meeting the expectation.

A best practice is to always measure estimated material and labor cost against the actual job cost on every job. This allows the contractor to quickly identify areas in need of improvement and areas of strengths. It is also important to keep in mind that labor may be fixed by the job market in any given area; however the skill set of your crews are a controllable variable that will greatly impact quality and efficiency. Material cost is another area where a given set of foam may be controlled by the market, but material performance does not only impact coverage, but efficiency as well.

These are the two key areas where contractors can separate themselves from the competition. The value of a well-trained, skilled and disciplined crew that understands the importance of maintaining their equipment and tools will have a positive impact across the board. The same can be said for material performance, with a faster emphasis put on training and performing to these competitive edges a company will potentially increase its bottom line.

IT STARTS WITH THE BIDDING PACKAGES

Spreadsheets and charts can help the contractor track and analyze financial statistics like material costs, labor costs, overhead, sales costs, and profit. Quite often, the market decides on the value of a foam installation; the good news is the contractor determines the cost of delivering that value.

As previously highlighted, the differentiation the contractor gains should be used to enhance the bottom line. With this in mind, there are times where spreadsheets and bidding tools can actually cause the undesired outcome of giving away an advantage to the marketplace. For instance, if someone bids by charging a certain margin above their cost, then any gains they achieve in performance may actually be given to the marketplace.

If the contractor is able to reduce the installation costs, then an increase in margin is required so the work remains at the market value for foam. Items like yield improvements and labor efficiency may be lost to the market. As with any business, understanding the market is difficult and requires significant investigation by the contractor to understand their market. Within a very competitive market, one of the key variables a contractor has is the cost of the installed material, and it is often confused with the cost of the material. It is essential to recognize that these are two very different numbers. The yield of a given foam product is critical to the overall cost of the installed material, while the cost of the material is simply a value placed on a given amount of liquid chemicals. The contractor therefore needs to have a documented understanding of material costs and their overheads to know how to price their jobs and adjust the profit margin accordingly.

Before the spray foam contractor bids on a job, they need to know precisely what it will cost to complete that particular job, including labor, materials, equipment etc. If the contractor doesn’t know what the installed material costs per board foot versus the cost per set, it will be challenging for them to have a full understanding of their cost.

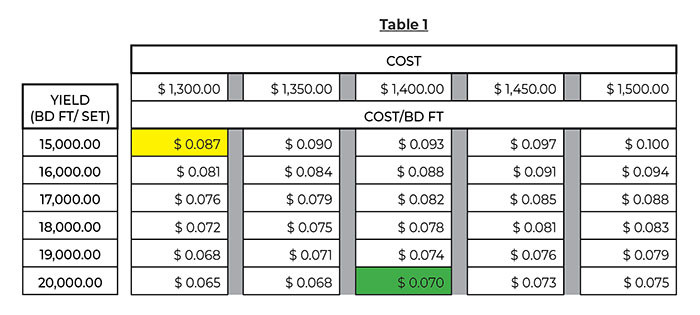

Table 1 is a perfect example of establishing how chemical companies often sell their products in sets, or by the pound, and the contractor sells their product by the board foot installed. Therefore, when determining the value of a given product, it is important to understand the actual board foot cost. Due to local conditions and equipment performance along with installers’ capabilities, there are indeed variations in product performance. Contractors need to review their individual performance data and not use numbers provided by their suppliers. Even when attempting to provide clear guidance to contractors regarding product performance expectations, suppliers can only provide guidance.

Something as simple as measuring the bd. ft. yield per a given volume of foam can vary between different contractors. For example, is the number including the studs and windows or excluding them? Is the number from high lift installations in the attic or from the walls? Therefore, the contractor needs to have their own calculations for yield and board foot cost. This will help them understand their business performance and growth. For example, if a contractor has their cost of foam at 35 percent of the bidding price and gets an additional

10 percent yield, they can retain that for the next job and see an additional 3.5 percent of their profit show up in the bottom line.

Notice in table 1, the variation in bd. ft. cost when compared to the cost per lb. once yield is taken into account. It is therefore essential that the contractor looks at the dollar per bd. ft. rather than just a blanket price per set.

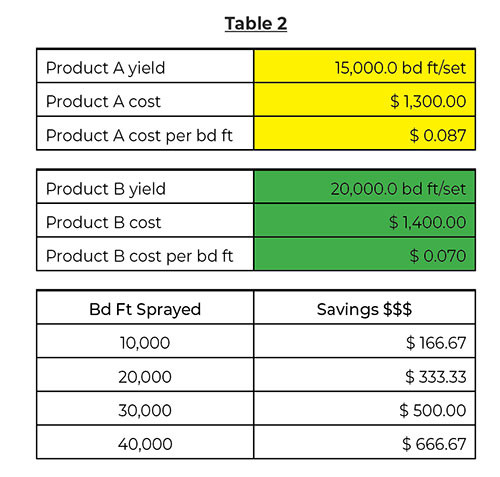

In the example in table 2, the contractor pays as low as $1,300 a set yet only gets 15,000 bd. ft. Compare that to paying the higher price of $1,400 a set with a 20,000 bd. ft. yield. The chemicals may cost more initially, but the business performs better overall. To calculate the advantage with an example from the chart, $1,300 ÷ 15,000 bd. ft. = $.087 a bd. ft. compared to $1,400 ÷ 20,000 bd. ft. = $.070 cents which results in a saving of $.017 per bd. ft.

Once a contractor is able to gain performance from a product by the combination of chemical cost and yield, they need to work to keep that benefit for themselves. While $.017 savings may not sound much initially, it results in 19.5 percent savings, which is enormous. Take our same example of bidding at 35 percent and we now see where the contractor can gain profits of 7 percent of their sales. For most businesses, this is a game changer. If the contractor has the opportunity to increase performance from a given product, they can potentially lose all that advantage by divulging the costs in a bidding spreadsheet or application presented to the customer. This may result in empowering the customer to lower the selling price, which leads to lower profit for the contractor.

Table 2 also shows an example of the magnitude of savings by board feet sprayed.

Many contractors are running their own books, or they have a designated employee to handle their bidding and estimating spreadsheets/charts. The distinction between the bid presented and the estimate calculation are often combined. However, the bidding documents and the estimate should be classified as two separate tasks. The estimate is a forecast of internal costs, for example labor and materials, and a bid is the proposal to the contractor’s prospective client.

If the contractor develops a cost advantage in the marketplace, then they should consider astutely gaining share via a well thought out bid, with significant effort to focus on not lowering the prevailing market price. Such an objective can be achieved in many ways but having the support of the end-use customer can be a win-win for both parties.

If the customer does not reveal the advantage they are receiving from their relationship with the better performing contractor, they can retain that benefit through to the future sale of their home, since the value of the insulation has not diminished. Often all parties give away their advantage to the marketplace by constantly revealing their advantage to the overall market. If any improvements are made in a contractor’s performance and these are translated into the bidding package, the advantage will be given away, and it could therefore result in not having the positive effect on the contractor’s bottom line. Consequently, the contractor should carefully protect their investments in the bidding process.

There really is a clever balancing act between full disclosure and protecting your competitive advantage. The contractor needs to address their USP (Unique Selling Points) in addition to showing the hard work they’ve put into planning the right solution for their potential customer. They should explain the benefits of their chosen approach, but also address the downsides of the alternatives, presenting the potential customer with a bid, which is clear and concise without giving too much performance information away.

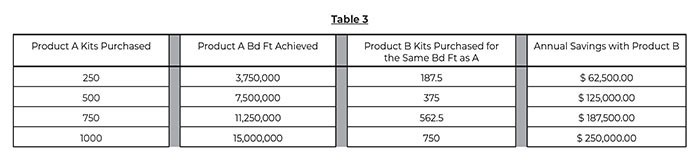

In conclusion, if the information from table 2 is annualized, it’s evident the contractor’s savings can be considerable as seen in table 3. If these savings are then retained, they result in an improved bottom line and a more valuable business. Product performance can indeed make or break a business. Choosing and utilizing the right product is a critical decision. Watching over product performance and measuring it regularly will support sustained business improvement when managed correctly. This potential profitability will allow for more freedom in the business, including: equipment improvements, employee benefits, increased market-share, and an enhanced bottom line.

Contact SES Polyurethane Systems

Direct any questions about increasing the edge of your spray foam business to SES:

Phone: 713-239-0252 // Website: www.sesfoam.com

*Spray Foam Magazine does not take editorial positions on particular issues; individual contributions to the magazine express the opinions of discrete authors unless explicitly labeled or otherwise stated. The inclusion of a particular piece in the magazine does not mean that individual staff members or editors concur with the editorial positions represented therein.

Disqus website name not provided.