COVID-19 & the SPF Industry

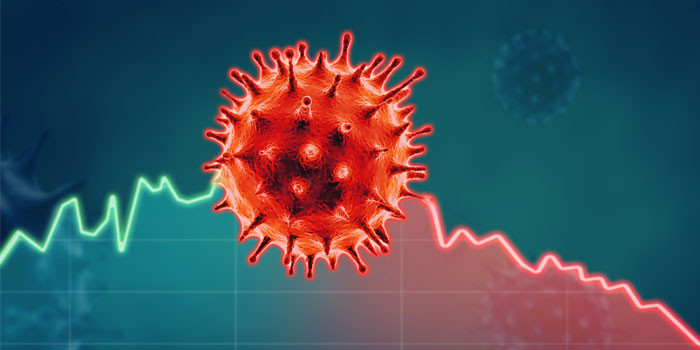

Summer 2020 – Spray Foam Magazine – The COVID-19 outbreak in the United States has affected roofing and insulation, just as it has the many other disciplines within construction. Stay-at-home directives and social distancing mandates have slowed both new and retrofit projects in both the residential and commercial arenas. However, the slowdown and stalling of projects has been highly dependent on region, as state and local representatives enacted lockdowns, some deeming construction an essential business and others not. As the states work individually to re-open on their own timelines, that too affects construction activity and spray foam contractors regionally.

The Spray Polyurethane Foam Alliance recently polled its members to gauge the impacts of the Coronavirus on their business and outlook for 2020. The survey garnered timely feedback on actual and forecasted impacts of the virus with a focus on project pipeline, employment, possible material and equipment shortages, and general lockdown instigated disruptions to business. The alliance also compiled informal commentary separately from industry leaders willing to share their thoughts on the issue. What the survey and informal poll reveal is insightful, though somewhat unsurprising.

When participants were asked how their company’s business (customers, orders, projects, cash flow) has been affected by COVID-19, 7 percent indicated, “Not at all, business as usual,” 23 percent indicated, “Slightly negatively,” 30 percent indicated,“Moderately negatively,” and 40 percent indicated, “Seriously negatively.”

“Although we’ve faced many logistical challenges due to the shelter-in-place order here in California, we were fortunate to have several large contracts for ‘essential businesses’ which have allowed our crews to continue working,” says Luke Nolan, president of Central Coating Company. “Our focus has been on keeping our team safe and employed.”

John Achille, vice president of Coastal Insulation Corp., stated, “We operate in New Jersey, New York, and Pennsylvania and all three states have taken a different approach to which businesses are deemed essential. Keeping the ever-changing laws and executive orders straight, and interpreted correctly, is a challenge.”

“We see consistent downturns in both the new construction and retrofit markets across the U.S. and Canada, however the impacts are hitting states in an inconsistent manner,” says Doug Kramer, president and CEO of Icynene-Lapolla, a leading manufacturer of spray polyurethane foam. “Much of this can be attributed to the timing of COVID safety rules, as well as the staggered lifting of those mandates by state.”

The survey asked members for their sentiment on their business outlook for 2020 in light of COVID-19. 20 percent of respondents indicated they were generally positive while 51 percent indicated they were generally negative, and 29 percent stated they were generally neutral.

“The challenges that have come with continuing operations in the COVID-19 outbreak have been unique,” says Bryan Heldreth, president of RPC Industries Inc. and Jackcrete of Virginia. “As primarily a government contractor, we have experienced surges of emergency work orders followed by notices that entire facilities were closing, and those work orders being put on hold. We also have clients who are critical to our nation’s defense who cannot close and need us there too, so we continue working.”

The survey also asked participants if they are experiencing staffing challenges as a result of the virus. 31 percent of respondents confirmed they were, 39 percent confirmed they were not, and another 30 percent indicated they were uncertain at the time of their survey responses.

Anticipating potential supply chain issues, as well accessibility of personal protective equipment, the survey asked participants if they are experiencing disruptions in SPF material availability as a result of COVID-19. 15 percent answered affirmatively, 51 percent said they were not experiencing material disruptions and 34 percent indicated they were uncertain at the time of the survey. However, responses to an inquiry regarding the current availability of personal protective equipment proved more problematic. 68 percent indicated they are experiencing issues acquiring PPE, 15 percent said they were not, and 17 percent indicated they were unsure.

“As a company with several chemical manufacturing facilities, we always maintain good stocks of PPE and have an excellent safety record,” says Will Lorenz, vice president of sales for General Coatings Manufacturing Corp. “Individuals like myself, as well as our company, have even made donations to local food bank organizations and area hospitals. We believe in people over profits.”

“The type of PPE used by our employees is not utilized in the healthcare profession and we generally maintain a 90-day supply as a matter of policy,” says Gary Harvey, general manager of Wedge Roofing. “We did place our typical order approximately a month earlier than normal to assure access and have yet to incur a supply chain issue. There are other operational tasks where our go-to face covering was an N95 type mask, just out of an abundance of caution. We ceased utilization of those approximately 5-7 weeks ago so as to not compete with healthcare professionals who are truly in need.”

Technology was also addressed in the survey. Members were polled about any increased use of webinar-based meetings as a means to reduce face-to-face interactions. 35 percent indicated they are using these tools and 25 percent indicated they are actively considering doing so.

Finally, the survey asked participants if they anticipate any financial distress with their business in 2020 due to the virus with 63 percent indicating they do anticipate that, 8 percent indicating they do not, and 29 percent stating they weren’t sure at this time.

“We are still able to work with very disciplined social distancing. Being in rural western Nebraska makes it much easier to keep crew members separate from others. However, because we are in an agricultural area we do expect a downturn in business as the prices farmers are getting for their commodities are very depressed due to export and trade problems,” says Brad Houlden, co-owner of Houlden Contractors, a spray foam contracting business he leads with spouse Shirley Houlden.

All factors considered; some members are taking a ‘roll up your sleeves’ approach to the situation. “In these times, my disaster plans barely apply or have already been exhausted, so we throw out the luxury of time and planning and do what we do best as a small business - we adapt!” adds Heldreth.

“At this point, we feel the true impact of this pandemic won’t really be felt until next year, which is why we are stepping up our efforts now in order to maintain a healthy pipeline of projects,” says Nolan.

Will Lorenz adds, “We are optimistic on the construction year. We see the overall economic conditions improving in the second half of 2020. Certainly, the virus containment success will be the immediate variable of the U.S. economy, but the distribution of SBA loans as well as overall consumer spending will factor in the long-term recovery.”

81 percent of survey respondents are active in residential insulation and 68 percent in commercial insulation. 14 percent of survey respondents are active in residential roofing and 32 percent in commercial roofing. In total, the survey pulled responses from 226 respondents.

All survey findings listed as percentages may be attributed to the member survey. Quotes included throughout the article featuring insights from industry leaders were provided at-will to the SPFA as separate informal commentary reflecting COVID-related business impacts.

About the Author: Kurt Riesenberg is the executive director of the Spray Polyurethane Foam Alliance (SPFA), the industry’s technical resource and voice. The SPFA promotes best practices and safety in the application of spray foam roofing and insulation and offers the industry’s most comprehensive and trusted Professional Certification Program (PCP). For information, visit www.sprayfoam.org.

Disqus website name not provided.